The Impact of Chip Shortage on the Medtech Sector and RAS Players

In the second half of 2021, most government and media attention was focused on chip shortages in the consumer electronics and automotive industries—the leading economy-driving industries for chips. However, over half the top MedTech products include semiconductors and firmware/embedded software.

![]()

While the medical semiconductor market only accounts for approximately 1% of the total semiconductor market, the need for these products raises ethical concerns because they enable important, life-enhancing treatments and operations. Protecting the supply and delivery of these medical technologies calls for having MedTech on the list of high-priority industries.

The three factors are driving the chip shortage

- Increased demand for consumer electronics

The COVID-19 shutdowns stalled activity at factories across the world, while at the same time, more people than ever were staying at home—and investing in at-home entertainment. The increased demand for consumer electronics coupled with reduced supply from limited factory activity resulted in a backlog of computer chip production that has yet to be resolved. - Supply chain disruption

The pandemic and its ripple effects severely impacted the overall global supply chain. Shipping ports that shut down early in the pandemic faced significant cargo bottlenecks when they reopened. The supply chain still hasn’t recovered, and ongoing worldwide labor shortages have contributed to the strain, which shows no sign of ending in the short-term. - The automotive industry

Modern vehicles rely on computer chips for electronic dashboards and innovative safety features, making the auto industry one of the largest drivers of the computer chip shortage.At the onset of COVID-19, car manufacturers canceled orders for new chips, expecting demand for new vehicles to drop off. When it didn’t, manufacturers couldn’t maintain normal production schedules, mainly due to supply-chain disruption combined with the current practice of having limited inventory. Looking ahead, the auto industry’s need for computer chips will only continue to increase.

How will this impact the MedTech market?

Over 70% of MedTech companies rely on a single supplier for semiconductors, so they all face the same long lead times that risk disrupting their production.

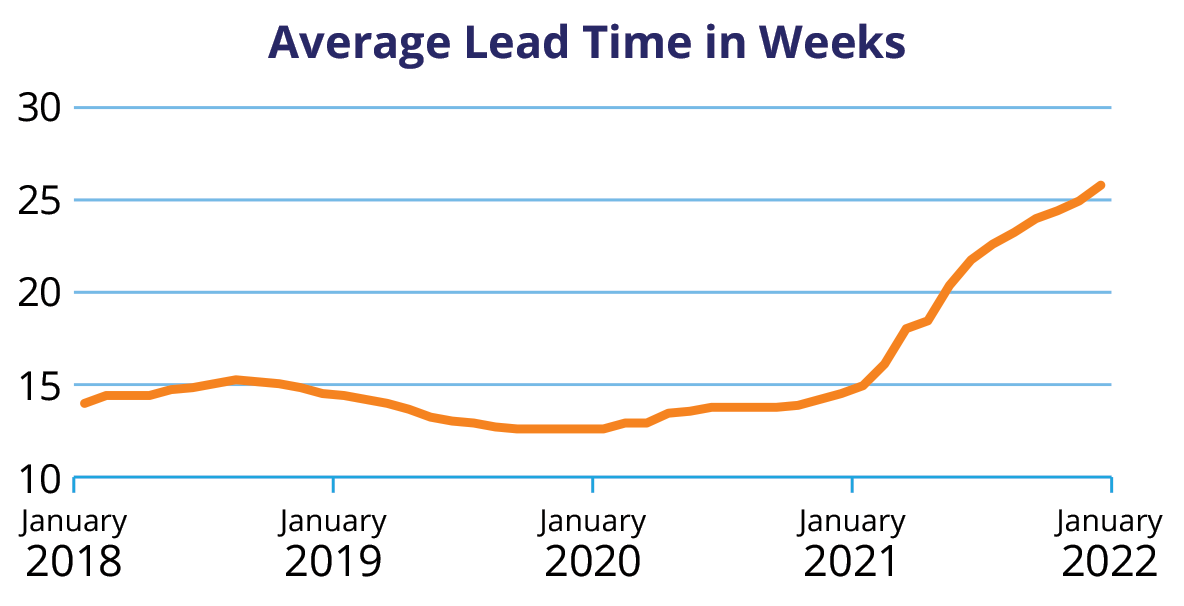

After the first wave of the pandemic, lead times for various semiconductor products ballooned from 50–80 days to 160–180 days, and in some cases more than 365 days for special components.

Companies have gone from carrying electronic component inventory for 30–60 days to almost no inventory—creating a pattern of on-demand sourcing. To maintain operational continuity, companies are forced to spend millions of dollars to purchase products available on the open market, with some products marked up 100% over pre-pandemic pricing.

Some companies are seeking potential alternatives, but due to the highly regulated nature of the industry and associated time for approval, any supply adjustments cannot provide a short-term solution.

How will this impact Robotic players?

Sales of robotic surgical platforms were primarily impacted by COVID-19 and the related slowdown of all elective surgeries. Following the massive adoption of vaccines, demand quickly recovered, however due to short supplies companies have been unable to fulfill the sales requests.

Companies have been forced to reduce their 2022 midyear sales forecast, as both the semiconductor and plastic material shortages have made it difficult to match production with increased sales. At the same time, to maintain interest and momentum while awaiting the components, some companies are sending to customers surgeon consoles and simulators to begin their robotics training before the robot arrives.

What’s next for Robotic and MedTech industry at large?

Lead times are expected to normalize by early 2023, as over-ordering to build up inventory slows. However, it will likely take longer for supply to fully catch up with demand and reach equilibrium.

In the meantime, government institutions are finding ways to support a faster recovery. With the European Chips Act, the European Union (EU) is looking to become a key player in the industry. The act provides public and private funding totaling €43 billion ($49 billion) and looks to increase the EU’s share of worldwide chip production to 20% by 2030—over double their 9% share today.

Other countries are also recognizing that chips are key to future economic growth. The U.S. House of Representatives recently approved federal funding for its semiconductor industry, a total of $52 billion with $39 billion earmarked for new fabrication plants or fabs development.

In terms of the robotic assisted surgery market, companies may continue to struggle to achieve on-time deliveries to their clients. Additionally, the industry landscape is becoming increasingly competitive, spurred by the entrance of large players to contend with the likes of Intuitive. This makes maintaining agreed upon delivery times even more imperative for companies to avoid losing current or potential clients to competitors.

References

- Graph: Susquehanna Financial Group

- Understanding the global chip shortage, a big crisis involving tiny components

- The global chip shortage: What caused it, how long will it last?

- EU outlines €43 billion plan to fix Europe’s chip shortage

- ‘Just-in-time to just-in-case’: EU’s $49bn chip plan shows tectonic shift in global economy

- Medtech CEOs sound off on semiconductor shortage, pushing Biden administration for prioritization

Subscribe to our newsletter for the latest news, events, and thought leadership